HIDA Post-Acute Insights

The home healthcare market is expected to grow from $100 billion in 2016 to $225 billion by 2024. Key factors driving this expansion include an aging U.S. population and the lower cost of home care when compared to other post-acute settings. As the market continues to expand, the number of providers offering home care services is expected to reach 46,000 in 2021, up from 37,000 in 2016.

HIDA’s 2017 Home Care Market Report offers an in-depth look at home healthcare market conditions, as well as the factors affecting utilization and demand. Below is a look at some of the key trends and data points gathered for this new HIDA report:

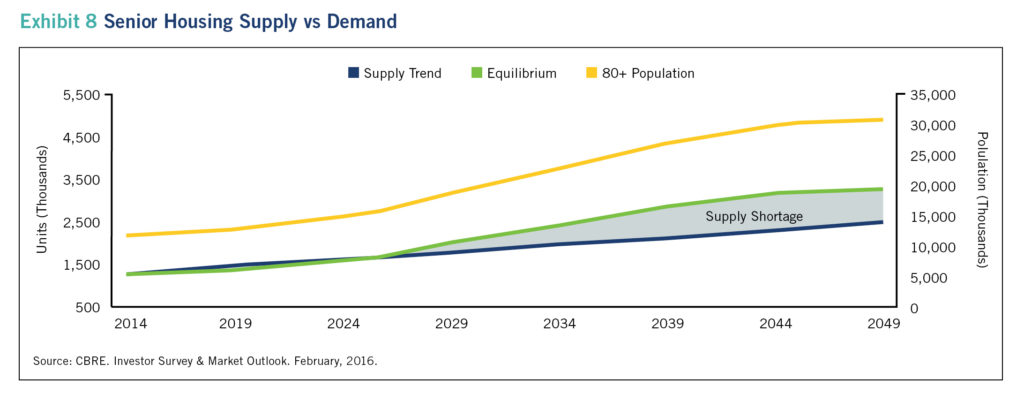

Due to the aging population, experts believe there will be a shortage in senior housing (which includes assisted living, independent living, memory care, and skilled nursing facilities) beginning in 2025 and reaching 1 million units by 2049 if not addressed.

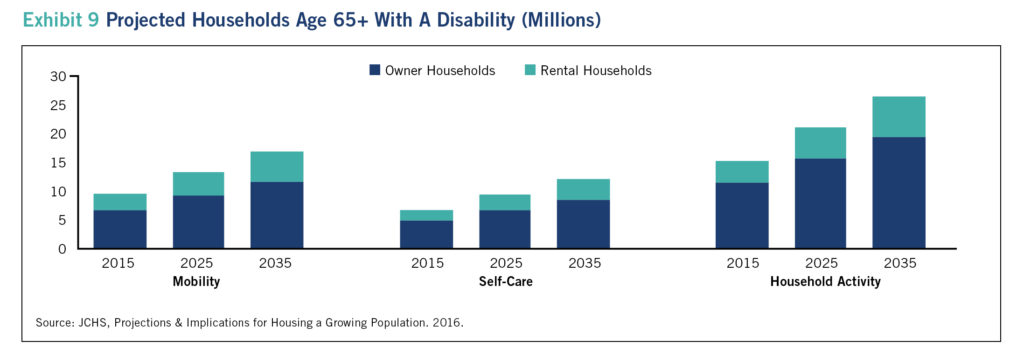

Projected Households Age 65+ with a Disability

The number of senior households with a disability are also expected to rise in the coming years. Between 2015 and 2035:

- Disabilities that limit movement will grow from 10 million to 17 million.

- Disabilities that interfere with an individual’s ability to care for themselves will rise from 6 million to 13 million.

- Disabilities that inhibit an individual’s ability to perform household chores will grow from 15 million to 27 million.

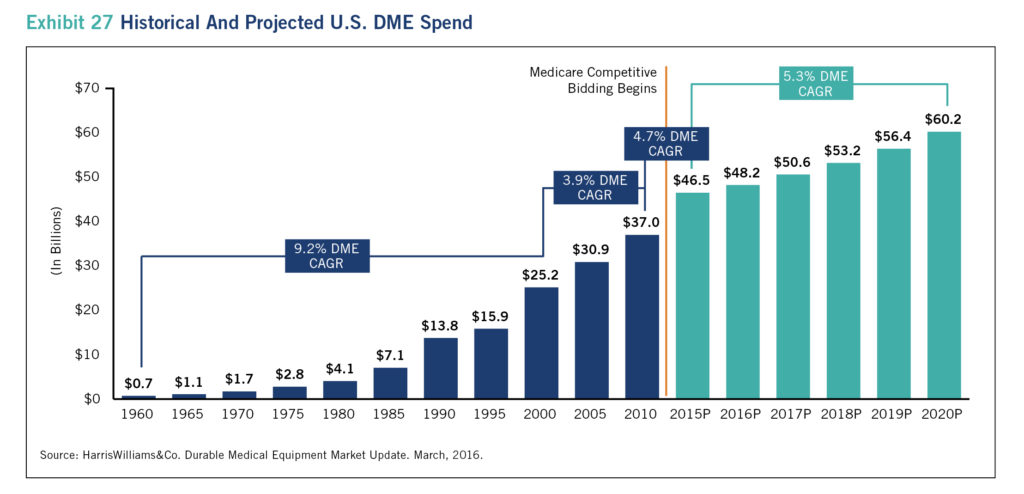

The increasing prevalence of both utilization of home care services and chronic disorders requiring long-term patient care are expected to contribute to higher spending on durable medical equipment (DME). Because of this shift, the DME market is expected to reach $70.7 billion by 2025, up from $50.6 billion in 2017.

Historical and Projected U.S. DME Spend

While there are several factors driving demand for DME, the Durable Medical Equipment, Prosthetics, Orthotics, and Supplies Competitive Bidding Program (CBP) will continue to limit DME suppliers’ Medicare reimbursement. Under the current process, reimbursements cover, on average, 88 percent of the cost of providing a piece of DME.

DME suppliers affected by the CBP are taking several steps to control costs, including cutting staff, limiting product offerings, and consolidating.

While these are some of the key trends affecting providers in the home healthcare market, providers in this space will face several industry challenges, including a shortage of skilled workers and key payer changes. For an in-depth look at these trends, visit www.HIDA.org/MarketReports to purchase your copy of HIDA’s 2017 Home Care Market Report.