By Gina Smith, CMRP,

Director of Business Development,

Health Industry Distributors Association

By now, you’re probably well aware that the extended care market is poised for rapid growth as the U.S. population ages. But with approximately 11,000 new beneficiaries becoming eligible for Medicare every day through 2025, home health stands to fill a crucial role by delivering care to consumers in ways that expand the existing post-acute care market even further.

HIDA’s latest Horizon Report Home Care Evolution: Increasing Demand Drives the Market provides several key data points that illustrate home health’s potential growth, both overall and in terms of purchasing trends. Here are some noteworthy statistics you might find useful for future customer or business conversations:

The market for home care products could reach $7.5 billion in three years. Home medical equipment – think beds, walkers, or wheelchairs – leads this growth, followed closely by miscellaneous supplies and equipment. So who’s buying or using these supplies? Traditional home health and nursing care providers command more than a 57 percent share of the provider market, followed by home hospice and home therapy services.

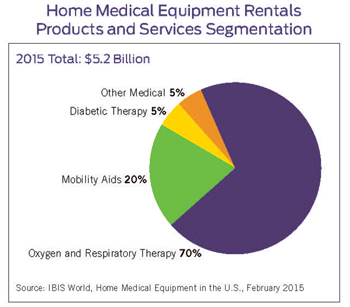

The market for home care products could reach $7.5 billion in three years. Home medical equipment – think beds, walkers, or wheelchairs – leads this growth, followed closely by miscellaneous supplies and equipment. So who’s buying or using these supplies? Traditional home health and nursing care providers command more than a 57 percent share of the provider market, followed by home hospice and home therapy services. DME rentals are driven largely by oxygen and respiratory therapy. Without a doubt, oxygen and respiratory products represent the largest market segment of home durable medical equipment (DME) rentals, accounting for nearly three-fourths (70 percent) of all rentals. Despite recent market growth, expect modest revenue increases through 2020. Medicare reimbursement reductions have affected DME suppliers’ profitability and are forcing providers to cut costs through workforce reductions.

DME rentals are driven largely by oxygen and respiratory therapy. Without a doubt, oxygen and respiratory products represent the largest market segment of home durable medical equipment (DME) rentals, accounting for nearly three-fourths (70 percent) of all rentals. Despite recent market growth, expect modest revenue increases through 2020. Medicare reimbursement reductions have affected DME suppliers’ profitability and are forcing providers to cut costs through workforce reductions.- Expect more home treatments as the efficient alternative to hospitals. Changing patient preferences, advances in clinical administration, and cost-containment efforts have all contributed to healthcare treatments shifting to the home. One of the more striking examples of this shift is with home infusion therapies, which are used when patient conditions are too severe to be effectively treated with oral medications. Treating patients at home or at alternate sites is nearly 90 percent more cost effective than inpatient delivery, with potential savings topping nearly $1,300 per day compared to hospital settings.

Looking ahead: CMS pilot targets home health savings

Home health’s future remains promising. In 2012, the Centers for Medicare and Medicaid Services (CMS) initiated a three-year pilot program to test the effectiveness and cost-savings of delivering home-based primary care to patients who are too chronically ill to visit a physician office. The results? More than $25 million in Medicare savings in the first year and a two-year program extension through 2017.

Early analyses indicate cost savings resulted from fewer hospital visits and fewer hospital readmissions for conditions such as high blood pressure, pneumonia, and diabetes. If approved by Congress, nationwide implementation of the pilot could yield up to $34 billion in Medicare savings over the next decade.

Many more future opportunities and challenges exist for your home health customers and the patients they serve. To read our full report and to access other HIDA Research & Analytics reports, visit www.HIDA.org/HorizonReport.