Provided by the Health Industry Distributors Association (HIDA)

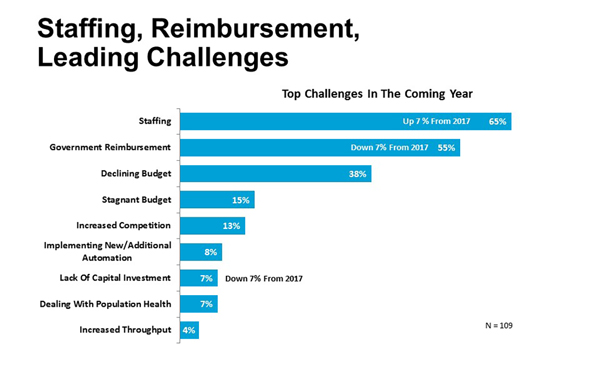

Sixty-five percent of hospital laboratory administrators identify staffing as their top challenge, a seven percentage point increase from last year, according to the HIDA Provider Survey: Hospital Laboratories Scrutinize Operations. To address these challenges, lab administrators plan to take steps to both attract new personnel and to increase their facilities’ productivity. This provider survey looks at the particulars of these steps, and how they may affect distributors. Here are some of the key takeaways from this research:

Cost reduction remains strategic focus

Though staffing is the issue most likely to keep lab administrators up at night, respondents identify cost reduction as their top priority for the next 12-18 months. Increasing the productivity of their existing staff comes in second, followed by recruiting new employees. One respondent commented that these moves are part of a broader strategy to cope with limited resources. In addition to cutting costs and boosting productivity, this individual remarked that they would be selective about the clients and patients they serve.

One factor driving labs to focus on costs are new payment cuts, such as the ones under the Protecting Access to Medicare Act of 2014 (PAMA). Specific strategies for responding to these cuts include focusing on utilization management, restricting access to more expensive tests, increasing prices for private payers, and developing a leaner and more automated work environment.

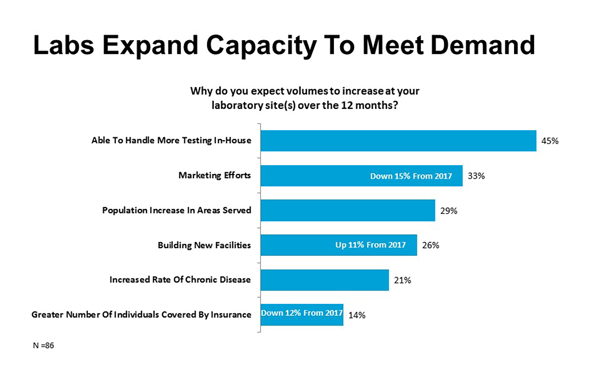

Majority of labs expect volume increase

The majority of hospital lab administrators (59 percent) anticipate greater volume in the next 12 months. Survey respondents attribute volume growth primarily to their ability to handle more testing in-house, although marketing efforts, population growth, and the construction of new facilities were also cited as important factors.

Labs plan to spend more on supplies

Over the next fiscal year, 47 percent of respondents say they their medical supply budgets will increase by 1 to 5 percent. A similar percentage say their laboratory supply budgets will increase. Only 28 percent of respondents say their medical supply budgets will decrease, while 29 percent say their lab supply budgets will decrease.

Capital equipment budgets remain flat or decrease

Half of respondents report their laboratory’s capital budget will remain flat over the next fiscal year, with 28 percent saying these budgets will decrease. Labs are primarily focused on replacing or updating existing capital equipment over the next year, with only 17 percent planning to invest in new types of capital equipment.

As hospital labs look to control their expenses, distributor reps can play a key role by guiding them to solutions that will address their concerns. While this may require guiding customers to cheaper options, it could also include educating providers on new equipment that can free up lab staff’s time.

For more information, and to see additional research reports in HIDA’s Provider Survey series, visit www.HIDA.org/ProviderSurveys.