The Protecting Access to Medicare Act (PAMA), passed in 2014, could lead to Medicare payment cuts for labs by as much as 50% over the next six years. Despite this potential loss of revenue, some key segments of the laboratory market may experience significant growth in the coming years.

HIDA’s 2017 Laboratory Market Report takes a look at the market conditions in the major laboratory market segments, including hospital labs, physician office labs, and reference labs. Here is a look at some of the key data points and trends collected for this year’s report:

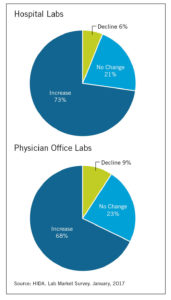

Lab Volume Change Anticipated By Providers In 2017

The majority of hospital and physician office lab directors expect testing volume to grow this year.

The majority of hospital and physician office lab directors expect testing volume to grow this year.- Hospital CFOs report increased investment in their laboratory departments. Approximately 23 percent of facilities are investing in new capital equipment, while 16 percent are replacing or upgrading existing capital equipment.

- The amount of healthcare spending devoted to preventive care is expected to reach 12 percent by 2025, from 7 percent in 2012. The amount spent on treatment is expected to fall to 51 percent by 2025, from 66 percent in 2012. These shifts will be partially driven by increased lab spending, as diagnostics play a key role in preventive care.

This year’s report also highlights a number of new technologies and markets that will support laboratory market growth in the coming years. These include:

- Molecular diagnostics. This type of testing detects specific sequences of DNA or RNA that may be associated with disease. The U.S. market for molecular testing is expected to reach $6 billion by 2024, from $2.9 billion in 2015. The range of these tests is also growing rapidly – between April 2015 and March 2016, approximately 5,000 new molecular tests were developed in the U.S.

- Companion diagnostics. These tests are largely used in treating cancer. They help providers gather necessary information so therapies can be tailored to an individual’s needs and condition. Currently, the Food and Drug Administration has approved only 23 of these tests, but the U.S. market for them is expected to reach $2.18 billion by 2019.

- Direct-to-consumer testing. These tests can be purchased by consumers without a doctor’s orders, and are marketed to consumers over media such as the internet and television. This market is fragmented in terms of what it offers, with tests sharply divided between genomic screening and traditional diagnostics. While this market is expected to reach $211 million this year, analysts believe it will exceed $350 million by 2020.

While these are some of the key areas that may drive laboratory and diagnostics market growth in the coming years, providers in this sector will need to contend with regulatory and payment changes introduced by PAMA, as well as a host of technological developments. For an in-depth look at these changes, visit www.HIDA.org/MarketReports to purchase your copy of HIDA’s 2017 Laboratory Market Report.