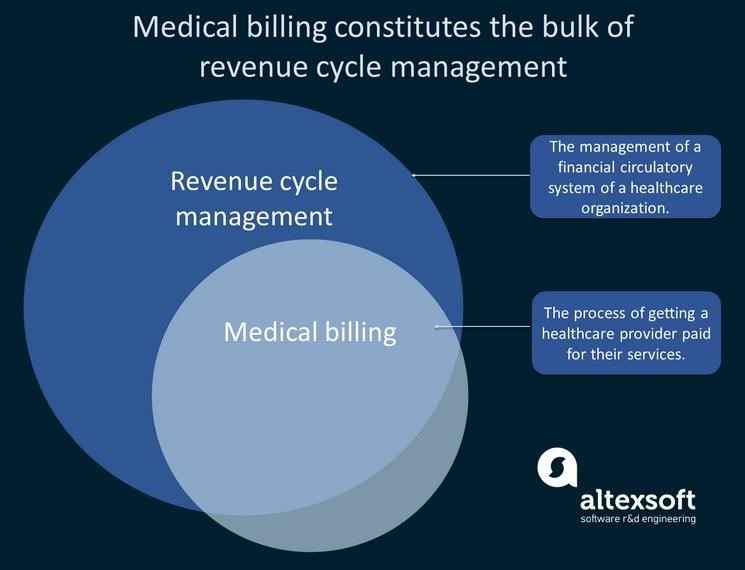

The practice revenue cycle is like the circulatory system of your practice.

A blockage in one area of the cycle/system can result in slower revenue flow and even the death of the practice if the blockage is not remedied.

Today, we look at ways to speed up the revenue cycle to ensure you and your team see the growth you need to continue serving your patient’s needs.

5 Ways to Speed Up and Improve Your Practice Revenue Cycle

You may think that one of the best ways to increase your revenue is by saving money. Perhaps you make special deals with healthcare suppliers to help your practice save money. While focusing on ways to save money within the healthcare supply chain is essential, it is not as important as focusing on your practice revenue cycle.

Here are five ways you can improve this cycle so you can increase your practice’s opportunity for growth and success.

1. Spend Time Streamlining Your Billing Process

The billing process is likely the most essential aspect of your practice’s revenue cycle. Unfortunately, this is often the most underestimated and therefore, the part that has the most problems.

Old debt is often the result of a poor billing process. Make sure you take the time to hire personnel adequately trained in billing practices or provide training opportunities for existing staff or new employees.

Investing in billing services or software can also help streamline your billing process. While these options require an up-front investment, they will pay off over time in:

- Increased collections

- Higher revenue

- Less old debt

- Less money spent on collection efforts/agencies

2. Educate Patients on Financial Responsibility and Medical Billing

Since at least 2015, patient’s financial responsibility has steadily increased, reaching 30% by 2018. It isn’t just the increase in cost that makes it more difficult for patients to pay their bills. In many cases, patients wait to see their healthcare provider when there is something wrong – an illness, injury, or condition that is impacting their daily life. Oftentimes, they miss out on work because of their symptoms, which makes it harder to pay their medical bills.

You can help patients and your practice revenue cycle by:

- Being transparent about costs

- Provide them with an estimate of their financial responsibility

- Educating them about insurance co-pays and deductibles

- Explaining the billing process (including sending a preauthorization)

- Making sure they understand that insurance companies can deny payment

- Working with them to create a payment plan that will benefit you both

3. Analyze the Data Often

You cannot manage what’s not measured. If you don’t know how your revenue cycle is operating and where you’re experiencing blockages in the cycle, you won’t know where or how to improve your revenues.

Take time to perform regular analyses of your financial data, including:

- How many new patients you’re bringing in each month

- Treatment acceptance rates

- Your billing cycle (particularly old debt of over 60-90 days)

Many billing or medical software options can create reports that provide the data you need to fully evaluate your revenue cycle.

4. Educate Your Team

In many practices, each team member only knows how their role plays into the overall function of the practice. They don’t necessarily understand the ins and outs of the other roles.

Set up training sessions in your practice so that all members of your team understand how scheduling, patient registration, billing, and collections work together. Teach them how to:

- Calculate patient financial responsibility

- Process claims

- Send a pre authorization

You can also teach them about the collections process and your practice’s financial goals.

5. Consider Patient-Centric Solutions

Medical billing and collections should be both transparent and easy for patients. For instance, certain services and tools help you and patients determine their out-of-pocket cost estimates before they schedule a procedure. Having an idea of what they will need to pay at the start can provide patients with some peace of mind, whereas receiving an unexpected bill of hundreds or thousands of dollars can cause stress and even reduce patient trust in their provider.

Other patient-centric solutions you might want to invest in include:

- Patient call centers for improved scheduling

- Providing patients with financing options

- Having a financial consultation with patients to discuss payment plans and options

- Referral management

- Online portals (or even in-office kiosks) that allow patients to review their benefits and make electronic payments

The easier you can make it for patients to pay and the more transparent you are about their potential costs, the more trust you will earn and the more payments you will receive.

Offer Services That Have Better Potential for Growth

Another way to ensure your practice’s growth and an improved revenue cycle is to offer services that patients really want.

This seems easier said than done in medicine, but it is possible. No, you don’t have to change the entire scope of your practice or change specialties. Instead, look at the data to see what patients want from healthcare professionals.

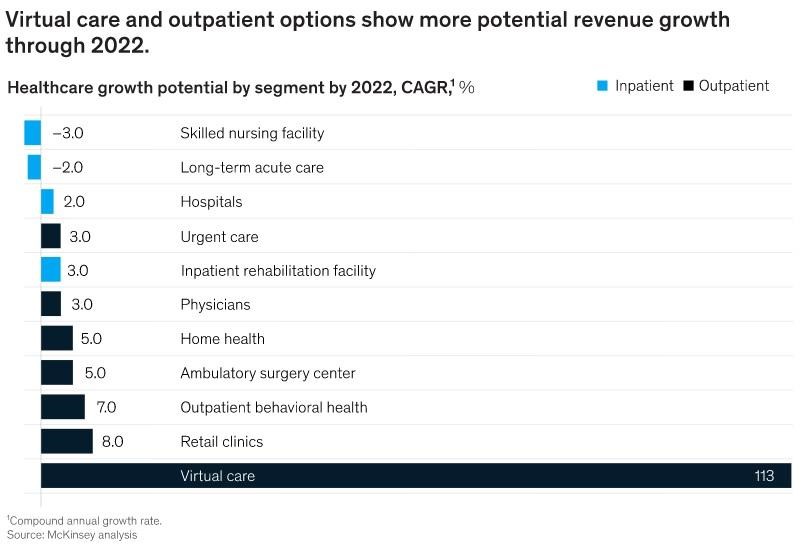

For instance, recent polls show that there are tremendous growth opportunities for practices that offer virtual care.

Offering online consultations helps patients save time and money (gas, wear and tear on their car, public transportation costs). Making appointments easier on patients helps ensure that they will schedule and keep their appointments, both of which will help improve your revenue. After all, how much have you lost out on over the past year due to appointments canceled last minute or due to patient no-shows?

Marketing Your Practice – The Starting Point

Of course, to start your practice’s revenue cycle, you need to get patients into your practice. Marketing your company will help you do that.

In the past, word of mouth within the community might have been enough for a practice to see growth. Nowadays, practices have more competition and patients want to learn all they can about a small business before they make a time/money investment.

Our team here at Repertoire is dedicated to delivering content like this to be shared with your clients on a regular basis to help you grow your relationship and bring value to them. Please take a few minutes to browse around our website and check out some of the podcasts and end-user lead generating videos.